Gestamp, the multinational specialized in the design, development and manufacture of highly engineered metal components for the automotive industry, presented today its 2024 first half year results. During the period, despite the lower market dynamism in key regions for the company, Gestamp has improved its revenues, EBITDA profitability and cash generation compared to the previous quarter.

Francisco J. Riberas, Executive Chairman of Gestamp: “The second quarter has confirmed the foreseeable slowdown in the vehicle production market for 2024 and the volatility in the transition to electric vehicles. In view of this scenario, we have a well-defined strategy that we have been implementing and that will allow us to maintain our competitive advantage. Focusing on profitability through efficiency and flexibility levers and a selective investment policy, as the main pillars of our strategy, will allow us to preserve Gestamp's financial strength.”

In the first half of the year, vehicle production volumes showed a year-on-year growth of 0.5%, a moderate performance that coincides with a tough comparison with the extraordinary growth of the first half of 2023. However, by 2024, a slowdown is expected in all markets where Gestamp has presence, except for NAFTA —where Phoenix Plan is in execution— and Asia —where Gestamp has a sustained growth above the market thanks to its competitive position in the electric vehicle segment—.

Focused on achieving objectives

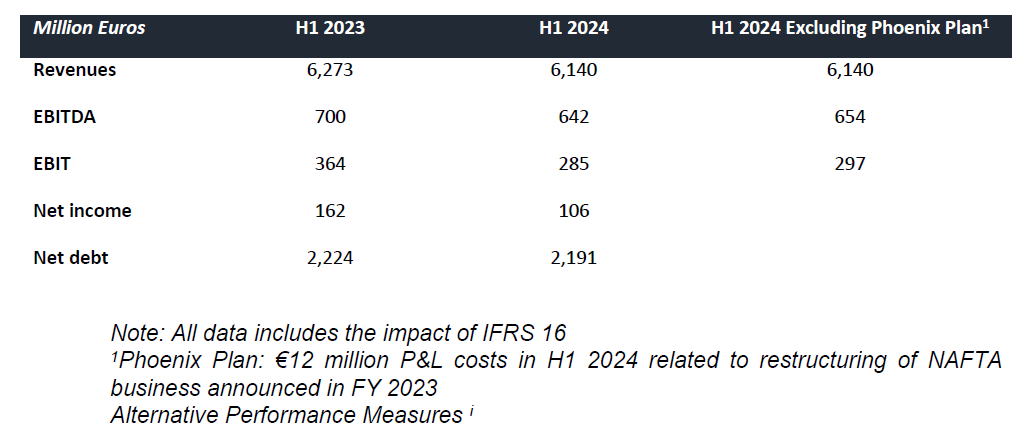

Gestamp reported revenues of €6,140 million (excluding the impact of the exchange rate) in the first half of the year, with above-market growth at constant exchange rates of 4.6 percentage points for the period. EBITDA in the period amounted to €642 million or €654 million excluding the impact of Phoenix Plan.

In line with the company's focus on financial discipline, Gestamp has maintained a trend reducing leverage, with a net debt of €2,191 million against €2,224 million in 2023.The company also recorded positive cash generation (FCF) of €77 million (excluding Phoenix Plan).

Gescrap

Gescrap has shown great resilience considering the generalized fall in raw material prices and, therefore, in scrap prices, with price dropping between -4% and -14% in different markets. This business unit has recorded an increase in profitability in the first six months of the year after reaching an EBIT margin of 7% (6.2% in H1 2023).

Phoenix Plan in NAFTA

The Phoenix Plan, a plan focused in NAFTA on increasing the profitability for this priority market for the company at the same levels as the rest of the regions, remains on track. During the first half of the year, Plan operative expenses amounted to €12 million, which represents 40% of the total amount forecast for 2024.

Compared to the previous quarter, Gestamp's results in this market show an improvement in the main indicators, with an EBITDA margin of 8.5% compared to 8% in the same period of the previous year and 4.5% in the first quarter.

Strategy to preserve financial strength

During June, forecasts for light vehicle production growth have been revised downwards. The context of declining volumes, together with volatility regarding the transition to electric vehicles in certain markets and inflationary pressures, will shape the rest of the year.

In this scenario of slowdown, Gestamp has well defined its strategy to preserve financial strength and maintain profitable and sustainable growth, as it has done since its IPO. Improving efficiency, enhancing flexibility in operations to respond to market volatility and a backlog excellent execution will protect the company's profitability while implementing a selective investment policy to preserve its financial strength.

Awards for sustainable manufacturing

Throughout the first half of the year, Gestamp's efforts in terms of ESG have been recognized by several prestigious international organizations. On the one hand, Ecovadis, a global company with more than 130,000 companies evaluated in terms of sustainability, awarded Gestamp a gold medal.

For its part, the analyst Sustainalytics has concluded that the company's risk of exposure to financial impacts due to ESG factors is low. Finally, FTSE Russell rated Gestamp with 4.5 points out of 5 in the FTSE4Good Ibex (BME) index, which measures the performance of companies with specific ESG practices.

As part of its sustainability strategy, Gestamp is working to promote circular economy. After the signing of agreements with Tata Steel UK, Arcelor Mittal and SSAB in 2023, the company has established during the first half of the year new alliances with leading international suppliers to provide OEMs with low-emission steel components. In Italy, this circularity agreement has been reached with steel supplier Acciaieria Arvedi and in Germany with ThyssenKrup and Salzgitter Flachstahl GmbH.